The Fine Print on Life Insurance Investment

The traditional idea of life insurance is to provide financial security for dependents after the term of life of the primary provider. In general, policy insurance is supposed to replace the income or the relevant expenses that the lost-income was funding.

With whole-of-life insurance, the policyholder pays monthly or annual premiums for a preset number of years. For example, a payment term of the contract can be anything between one premium to multiple premiums that last till the maturity of the contract (usually age 100 or later). The assumption is that the contract value should be able to give you value equivalent to your life insurance cover. However, here is the catch:

- Premiums for whole-of-life policies are usually more expensive than term life policies because it is certain that the insurance company will eventually payout. These policies are sold at extremely high assumed growth rates at 6% per annum and above.

- The diversified holdings portfolio rarely yield the kind of projected returns that whole life promises or projects.

SO WHAT’S THE ALTERNATIVE?

A better way to structure your investment plan is to invest in Term Life Insurance rather than whole life, and invest the premium savings in a tailor-made portfolio that meet your financial goals.

As the name suggests, Term is a type of life insurance that provides a potential death benefit for a fixed period. Term insurance is the most cost-effective way to get a guaranteed life insurance benefit for a defined amount of time. Two features make it an attractive option:

- A contractual guarantee on both the premium and the survivor benefit for a defined amount of time – usually 5-35 years or till the age of 80 whichever comes first

- There is no cash accumulation and the carrier will not pay dividends or apply interest to your account

The benefit here is the opportunity to create an incremental revenue source by investing the amount saved on a whole life insurance premium that is both realistic and immediate. Basically, term insurance is far less expensive than whole life insurance in the beginning – so with the difference in costs for the different policies, there is wealth created here that can exponentially grow with the right savings and investment portfolio.

Consider this: a pure term insurance policy could cost you as little as $200 a month as compared to the actual $700 or $800 premium for a whole life policy. Reinvesting the substantial difference with a growth potential of 2 to 3 times more is definitely a smarter way to manage your savings.

CASE STUDY:

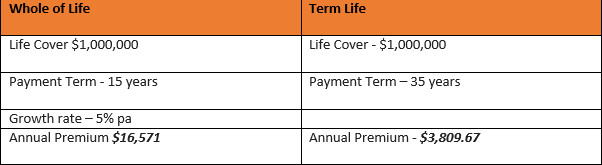

A case in point is this simple illustration that demonstrates a wealth opportunity of $12,000. With the right kind of financial advice, this can be reinvested into an incremental revenue plan.

For the same amount of life cover and policy term, you would pay significantly lesser premiums. The current trend in the UAE veers toward whole life insurance policy investments. But for those wanting to see financial rewards during their lifetime, there are several options and ways to restructure and purchase the cheaper term insurance policy today and invest the difference into other markets and portfolios that can give you a better yield.

In fact, the corpus received as a surrender value from your existing policy would be a great starting point!

I will be sharing more information around this topic in upcoming posts.

Please leave your thoughts or questions in the comments section.