Protecting Your Business with Life Insurance: Part 1

As an entrepreneur, your business is probably your most valued asset. Especially considering not just what it’s worth financially, but also the time and toil that has gone into making it what it is today.

Protecting your business then is natural instinct, and you’ve probably taken some key measures towards securing your life’s work.

You have likely insured your tangible assets, computers, buildings, put in place protections for all Intellectual Property with patents and copyrights, and even thought of contingency plans to protect your profits when the inevitable market dips come.

You may have gone to many measures to shelter your business from as many unexpected losses and setbacks as you can imagine befalling it in the future. There is one setback, however, that is sometimes missed out by oversight.

Business owners often fail to prepare themselves for what might happen in the event of the loss of a key person in the organization to sudden illness or death.

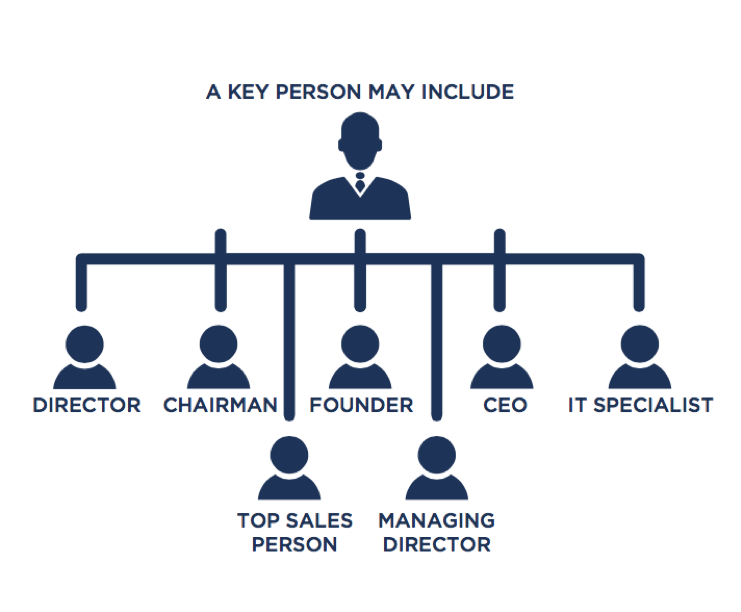

A key-person is someone who is directly responsible for the profitability and financial success of a business. Key people have usually spent years with an organization, or in the case of a newer company, they have proven themselves vital to its financial success.

The loss of said key person often triggers a deep, long-drawn financial impact that can leave a company crippled, if unprepared.

For instance, have you wondered what the repercussions might be of losing your CEO, CFO, Managing Director, or even your top-performing salesperson? Each one of these people more likely than not to play a direct part in your company’s ability to continue to generate revenue.

While it is a difficult set of circumstances to prepare for, the truth is that businesses sometimes find themselves facing an unforeseen set of losses and expenses to fill the void left by the deceased key contributor.

The loss that follows is multi-dimensional. There is, of course, the emotional impact, which takes strength and sensitivity to deal with. But further, there is a tangible financial loss incurred by a sudden and immediate drop in revenue as a result of the absence of the key person, and the costs incurred to fill that newly-formed gap in the organization.

The impact would potentially put a huge dent in your company’s bottom line, and recovery could take a longer time than you would expect.

Can You Prepare Your Business for this Loss?

Yes, you absolutely can. Like in most cases, it takes some planning and the implementation of the right tools. One tool that business owners turn to is ‘Key Person Insurance’, an application of life insurance that plays a crucial role in business protection and risk management.

What is Key Person Insurance and How Does It Work?

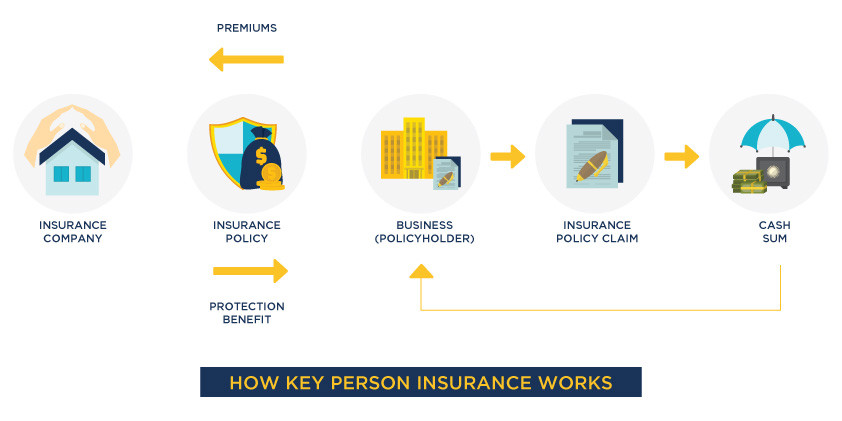

Key Person Insurance involves a business purchasing a life insurance policy in the name of a key individual or for each of its key people. A key-person is usually a core team member and has a direct impact on the organization’s ability to generate revenue and profits.

Key people include C-level executives like the CEO, CFO, and the CTO, senior management members like the Managing Director, the company’s Chairperson, and direct revenue-generators like your top-performing sales executive, amongst others. Depending on the nature of your business, this set of key people would vary from organization to organization.

Apple, for instance, in addition to its CEO, CFO, and CTO, would also list as a key person its Chief Design Officer (Jonathan Ive), who is responsible for the look and feel of every product, its hardware, the user interface, packaging and more.

His job, quite obviously, is integral to the success of Apple’s products, its market shares and its profitability on the whole. ‘Jony’, as he is commonly called, definitely qualifies as a key person for Apple Inc.

- When purchasing Key Person Insurance, one of the first steps would be to identify who a company’s key people are. This is done by assessing the roles and contributions of important people within the company, their talent, skills, relationships and other aspects that make them valuable assets. These people are typically integral to business success.

- The next step would be to evaluate and assign a tangible value to each key person’s contribution. In other words, should the business lose said key person, how much of a financial loss would the business suffer?

How much revenue would the business not generate, and how much more time and money would it take to recruit and train a replacement until they are able to perform as well as their predecessor?

These are all factors that are taken into consideration to arrive at the amount of coverage that a business would like to purchase for a key person.

The amount of protection is sometimes calculated as a multiple (five to ten times) of the key person’s annual salary or arrived upon as a multiple of attributable profits generated by the key person.

The business would then decide on the amount, purchase a policy of that value in the name of its key personnel, and in the event of sudden illness or death, the company (as beneficiary) would receive the proceeds.

Benefits of Key Person Insurance

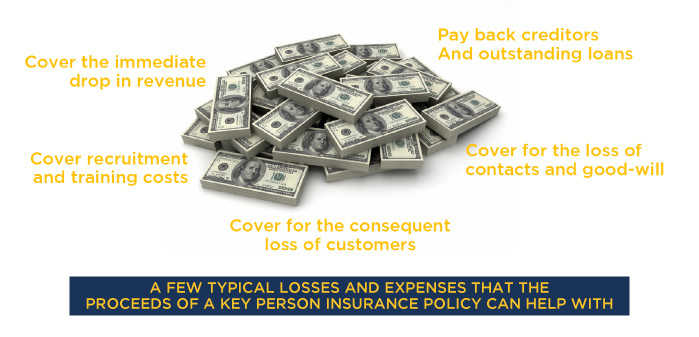

The proceeds then go on to cover the substantial and unexpected loss that the business incurs as a result of losing the insured key person. The money acts as a reserve to soften the several financial blows the company would suffer in such circumstances.

These include the immediate consequent drop in revenue, the potential loss of customers, contacts, and goodwill built in the industry by the key person, paying back any creditors and outstanding loans, and recruitment and training costs to replace the key person.

The cash also helps the company to suffer minimal financial loss over the months (or years, perhaps) it might take for someone new to step up and truly fill the shoes of the key person the business has lost.

Preparing for the worst has always been a winning strategy. It is difficult to predict the many hurdles and hardships an organization has to overcome as it grows, but it is possible to take the right precautionary measures to ensure that the impact is minimal.

Key Person Insurance is one of those precautionary measures and it has saved many organizations from drowning under the financial pressures that come from unexpectedly losing a key person.

For small and medium businesses, family businesses and rapidly growing startups it is often one or two core team members that carry all the load. In such cases, a contingency measure like key person insurance plays an even greater role.

Protecting your business in the event that it loses one of the people that are considered the company’s most valuable, irreplaceable assets, could probably prove to be one of the most treasured tools in your business planning and risk management arsenal.