Equalize Your Estate with Life Insurance

Your Life Insurance policy can become a key estate planning tool to help ensure a fair distribution of your assets amongst your heirs.

The Challenge

Your estate is much more than just money. It is a complex collection of a lifetime of valuable assets including your business, your home and other property, your savings and perhaps other heirlooms that are a part of your family’s legacy.

Dividing these assets fairly amongst your heirs is a difficult task. Dividing your business or your family home is even harder. Further, if you decide to hand one of these primary assets down to one heir, how would you fairly balance that inheritance for the other heir? Will multiple ownership cause problems for the business and amongst your children?

These are questions that left unanswered, bring with them disharmony and conflict that you would not want to bring upon your family.

How Life Insurance Helps

You can use your Life Insurance policy to add liquidity to your estate. After evaluating your estate, and coming to a decision on how you would like to divide it amongst your heirs, a suitable amount of life cover can be purchased to balance out your estate with cash.

The proceeds from the policy can be used to equalize the value of your hard-to-divide assets, so that each heir is left with the share of inheritance that you want them to receive.

The Benefits

- Liquidity: The death benefit not only provides the cash to balance inheritances, but also provides a safety net in the face of premature death.

- Tax-sheltered Proceeds: Using solutions like the establishment of a trust, the death benefit that your heirs receive can be accessed tax-free, no matter what the value of your estate.

- Cash Value: The cash value of a Life Insurance policy grows tax deferred, and tax-free withdrawals are permitted when structured properly.

- Source of Premiums: Income and/or stock from a family business can be used as a source of annual premiums towards the policy.

- Return on Premiums: Life Insurance is considered a safe, lucrative investment. Returns are fixed, predictable and healthy, as compared to many other investment options.

A Case Study

Arun and Rhea, both in their early fifties, are the owners of a profitable supermarket chain. Their business is worth $4 million, and their other assets amount up to $2.5 million in total.

Rahul, their older son, is actively involved in the business as General Manager, whereas his brother, Anish, is pursuing a successful career in photography, and is not involved in the family business.

Arun and Rhea want to leave the business, worth $4 million, entirely to Rahul, but that would leave Anish with a significantly smaller inheritance of $2.5 million, which makes up the rest of their assets.

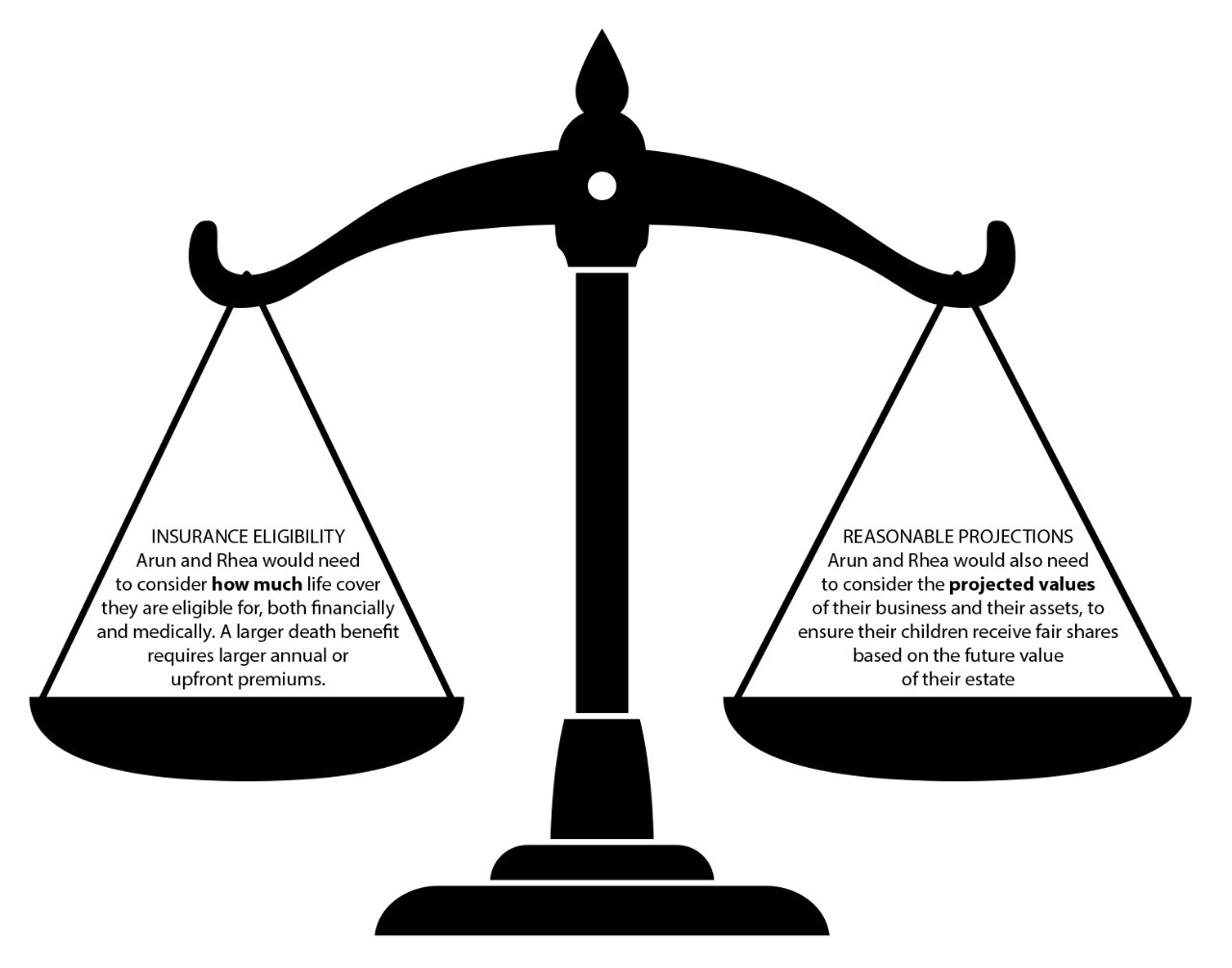

Key Considerations

Solution: A life insurance policy worth $1.5 million would provide the liquidity to equalize and balance the inheritances left to both siblings.

As always, feel free to reach out to me if I can weigh in or share some advice around Life Insurance used for inheritance planning, or anything else Life Insurance related. Better yet, join me for a weekend run or a bike ride at the Qudra Lakes, and we can squeeze in a numbers-discussion in between intervals.